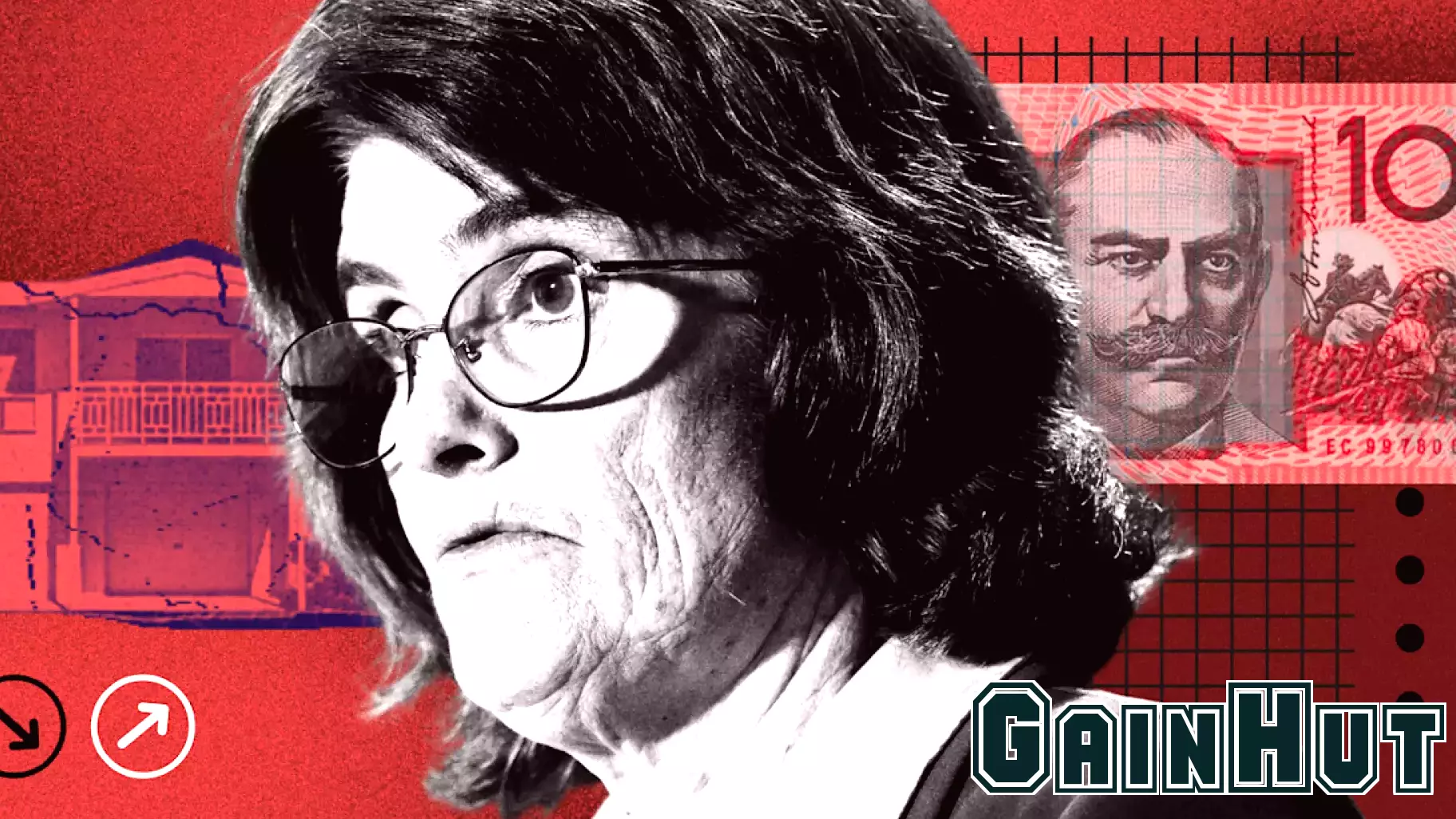

Urgent Call for Reserve Bank to Utilize Special Powers for Interest Rate Cuts

April 7, 2025 - 13:00

The Reserve Bank has the authority to convene an emergency meeting of its board to adjust interest rates, a move that many experts believe is necessary given the current economic climate. With financial markets experiencing significant declines, the urgency for action has never been more critical. Analysts are warning that the risks associated with inaction are now at extreme levels, potentially leading to further instability in the economy.

As businesses and consumers grapple with rising costs and decreased confidence, a reduction in interest rates could provide much-needed relief. Lower rates could stimulate borrowing and spending, helping to stabilize the markets and foster economic growth. The call for the Reserve Bank to act swiftly is echoed by various sectors, emphasizing that proactive measures are essential to mitigate the adverse effects of the ongoing financial turmoil.

In this challenging environment, the Reserve Bank's ability to respond decisively may prove crucial in steering the economy back towards stability and growth.

MORE NEWS

January 31, 2026 - 02:31

Senate passes funding deal but a partial government shutdown is on tap for this weekendThe U.S. Senate has successfully passed a short-term funding package, a critical step toward maintaining federal operations. However, the threat of a partial government shutdown beginning this...

January 30, 2026 - 18:27

Onity Group Announces Closing of $200 Million Senior Notes OfferingWEST PALM BEACH, Fla., Jan. 30, 2026 – Onity Group Inc. has successfully completed a significant debt offering, raising $200 million in capital. The transaction was finalized through the...

January 30, 2026 - 11:29

In Graphic Detail: The puny nature of regulatory fines compared to Big Tech’s financial prowessGovernments worldwide are increasingly wielding regulatory fines against technology giants for various infractions, from antitrust violations to data privacy breaches. However, a stark comparison...

January 29, 2026 - 23:05

German Finance Minister Calls for Discriminatory Taxes on Large U.S. Tech Firms - Americans for Tax ReformGerman Finance Minister Lars Klingbeil has called for the implementation of a new digital services tax aimed squarely at large international technology corporations. The proposal, outlined in a...