Exploring the Recent Decline in IPO Markets

2 October 2025

So, it turns out Wall Street’s not throwing parties like it used to. And no, it’s not because they ran out of champagne. The Initial Public Offering (IPO) market, once as bubbly as a shaken soda can, has been fizzling out lately—and everyone’s wondering what’s going on. Is the IPO scene going through a rough patch? Or did it just ghost us for the crypto crowd?

Let’s buckle up and take a ride through the highs, the lows, and the downright “what-were-they-thinking” moments behind the recent slump in IPOs. Put on your financial seatbelt—it’s about to get bumpy (but fun, promise).

What the Heck Is an IPO Anyway?

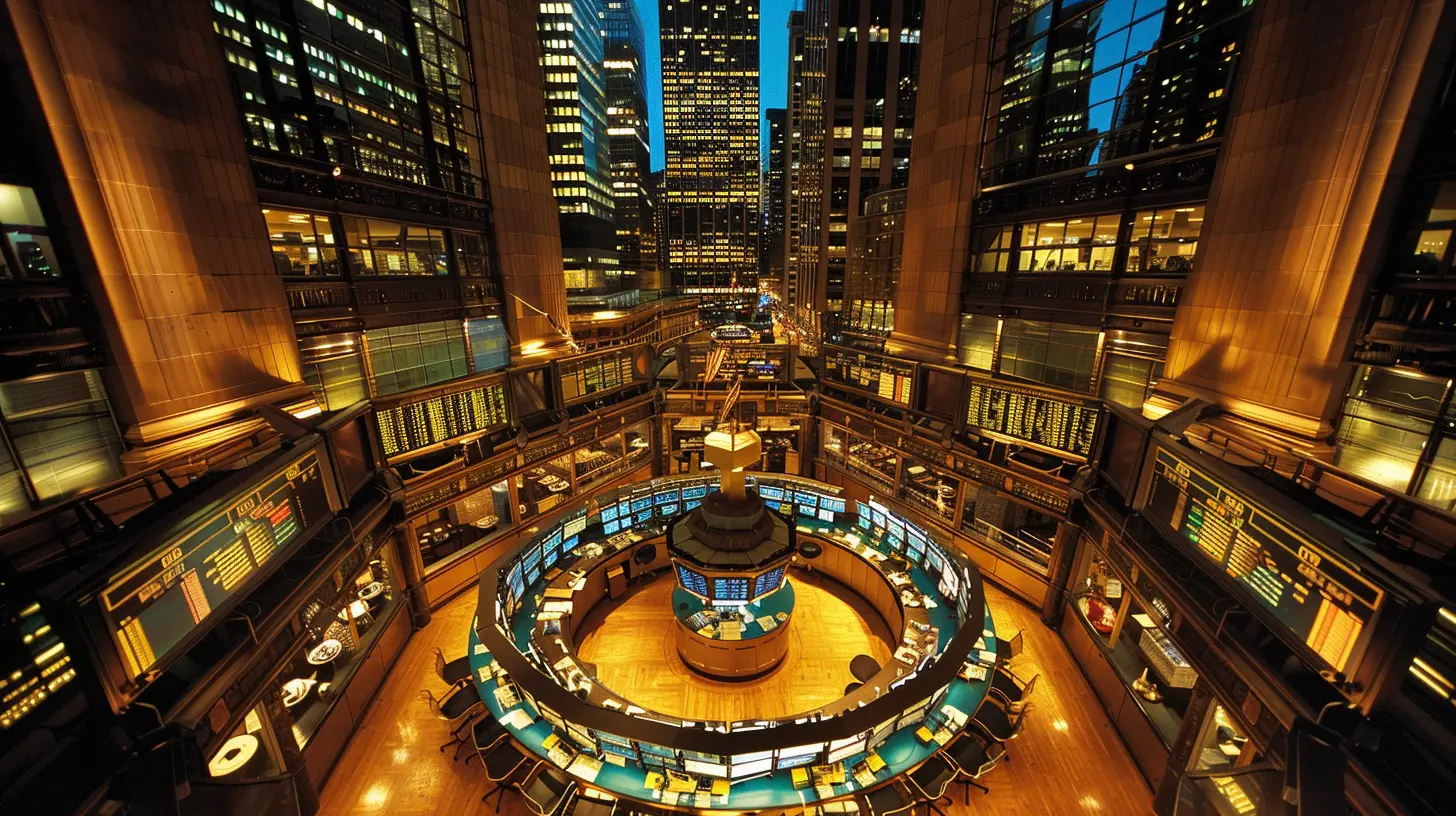

Before we dive into the deep end, let’s make sure we’re all floating in the same financial pool. An IPO, or Initial Public Offering, is when a company decides to stop being the mysterious, private garage band and goes full rockstar—inviting the public (and their wallets) to buy shares of their company for the first time.Sounds glamorous, right? They ring the bell at the stock exchange, people cheer, founders cry, and investors foam at the mouth hoping to ride the next Tesla or Google rocket. But lately… crickets. The IPO stage is disturbingly quiet.

A Quick Look Back: The IPO Boom That Went Boom

Remember 2020 and 2021? Those were the golden days. IPOs were like avocado toast on a brunch menu—every startup had one. Meme stocks were trending, SPACs (Special Purpose Acquisition Companies) were basically printing money, and companies were going public faster than you could say “unicorn valuation.”Companies like Airbnb, DoorDash, Robinhood, and Rivian hit the market with sky-high valuations. It was madness. But then... the music stopped.

Now, IPOs have become as rare as an error-free IRS website.

The Recent Decline: Where Did All the IPOs Go?

Here’s the million-dollar question: why did the IPO party come to a screeching halt? Let’s break down the usual suspects:1. 📉 Market Volatility – The Mood Killer

If IPOs were a first date, the stock market recently has been that guy who keeps checking his phone and talking about his ex. Not exactly confidence-inspiring.Between inflation worries, rising interest rates, geopolitical tensions (looking at you, war in Ukraine), and recession fears, investors have been skittish. And when investors are nervous, IPOs start looking like risky Tinder swipes rather than solid long-term relationships.

Companies are smart enough to know when their stock might flop harder than a straight-to-DVD sequel—so they hit the brakes.

2. 💸 Rising Interest Rates – Show Me the Money (Or Not)

Thanks to the Federal Reserve going on a rate-hiking rampage, borrowing money has gotten pricier than a cup of artisanal coffee in Brooklyn. Higher interest rates mean it's more expensive for companies to grow, especially those that aren’t profitable yet (which, let’s face it, describes a LOT of IPO hopefuls).When cash isn't cheap, those pie-in-the-sky growth projections start looking more like fairy tales. Investors started demanding real profits instead of “we’ll-make-money-in-2030” business models.

3. 🧻 The SPAC Hangover – Too Much of a Good(?) Thing

SPACs were the tequila shots of the IPO market. Easy to do, fast, and sometimes regrettable. SPACs allowed companies to go public without the usual scrutiny of a traditional IPO.But as you can imagine, that led to… shocker… some less-than-stellar businesses entering the public markets. When several of them tanked post-listing, investors started side-eying the whole process. Trust took a hit. And when trust vanishes, IPOs get ghosted.

4. 😬 Underwhelming Debuts – The Buzzkills

Let’s be honest, nothing ruins a party like a bad performance. A few high-profile IPOs in recent years faceplanted right out of the gate.Take Robinhood, for example. Massive hype, flashy marketing, and then… share prices dropping faster than your Wi-Fi signal during a Zoom meeting. When enough IPOs underperform, it sends a loud signal: “Maybe now’s not the time to put your company on the stock market stage.”

So, Are IPOs Dead?

Not quite. They’re more like a hibernating bear—still alive, just waiting for warmer weather and fewer interest rate hikes. While the market’s cold right now, the IPO beast can awaken quickly when conditions improve.Plenty of companies are playing the waiting game, watching from the sidelines like nervous kids at a middle school dance. “Should we go in? Is now the right time? What if we trip?”

Spoiler: Once the Fed signals lower interest rates and market volatility calms down, we’ll see IPOs popping up again—like daisies in spring.

The Curious Case of Delayed IPOs

Let’s chat about the IPO pipeline—because it’s full. Like, overstuffed-burrito full.Mega unicorns (we’re talking $1B+ valuation startups) like Stripe, Instacart, and Reddit have all been flirting with going public. But none of them have taken the plunge recently. Why? Timing.

Delaying an IPO isn’t always a bad move. It’s like waiting to sell your house until the market rebounds. These companies don’t want to IPO into a downturn and get slapped with a discount price tag.

So they’re biding their time, raising funds privately if needed, and waiting for the “all clear” signal from the economy.

When Will the IPO Market Bounce Back?

We’re not fortune tellers (though we do have strong crystal-ball-vibes), but here’s what experts say will trigger an IPO comeback:- Stabilized interest rates: Once the Fed chills out with the hikes, growth companies won’t feel like they’re swimming against a tsunami.

- Improved investor confidence: If markets stop acting like caffeinated squirrels, people might start feeling safer about buying IPOs again.

- Successful flagship IPOs: All it takes is one or two blockbuster IPOs to flip the narrative. If Reddit or Stripe goes public and crushes it, the floodgates might open.

Until then, it’s a waiting game. But hey, delayed doesn’t mean denied.

What This Means for Everyday Investors

Now, you might be wondering: "Okay, cool story, but how does this impact me?"Well, if you’re someone who jumps on IPOs hoping to catch the next Apple, this slowdown probably saved you a few dollars—and some heartache. IPOs are notoriously tricky anyway. They can either shoot for the stars or crash harder than my fantasy football team.

That said, fewer IPOs right now means fewer hot new stocks to invest in. But that’s not all bad! It’s a great time to research, build watchlists, and get your investing game plan ready for when the markets heat up again.

Think of it as a preseason warm-up. Stretch those financial muscles.

Final Thoughts: The IPO Market's Not Broken—Just Taking a Nap

So yeah, the IPO slowdown seems dramatic, especially if you're used to the hype-fest of 2020-2021. But in the grand scheme of things, this is just part of the market's natural cycle.Remember: what goes down must eventually go back up (unless it's a Blockbuster Video store). The market always swings back, and IPOs will return. Stronger. Smarter. And hopefully with fewer SPACs and more substance.

In the meantime, keep your eyes peeled, stay informed, and maybe—just maybe—avoid jumping into the next shiny thing without doing your homework. IPOs will be back. And when they are, you’ll be ready to rumble.

all images in this post were generated using AI tools

Category:

Market TrendsAuthor:

Uther Graham

Discussion

rate this article

1 comments

Dana McGrath

Looks like IPOs took a vacation—unfortunately, they forgot to send a postcard! While they're soaking up the sun, we’re left wondering if the market is just playing hard to get. Let’s hope they return with a beach body and better numbers!

October 12, 2025 at 10:36 AM

Uther Graham

Haha, great analogy! It certainly feels like the IPO market is in hibernation. Let’s hope for a rejuvenated comeback soon!